You pride yourself on working well and getting along with everyone, at least professionally. However, there is an auditor that seems to get under your skin. What do you do? Well, although there may not be a “magic bullet” to all make it better. I propose the following to get you through the situation at hand:

Topics: Contracts & Subcontracts Administration, DCAA Audit Support, Government Regulations, Federal Acquisition Regulation (FAR)

If your company has an accounting system audit in the near future, now is the time to get prepared, before DCAA starts knocking at your door. So, what are the common deficiencies? We are going to address the typical post award accounting system audit and deficiencies that DCAA frequently identifies during an audit.

Topics: Accounting System Compliance, Government Compliance Training, DCAA Audit Support

Schedule K is one of the most important parts of the Incurred Cost Submission and is an area of great interest for the Government and its auditors. This VLOG will briefly explain the Incurred Cost Submission, how to complete Schedule K, and the importance of Schedule K.

It has been a busy and exciting third quarter here at Redstone GCI! We have become both a certified Costpoint GCCM implementation partner with Deltek and an approved Deltek Pro Bookkeeper partner! Somehow, we are already in the final quarter of the fiscal year, and it looks to be a quarter full of new opportunities and year end preparations.

Topics: Deltek Costpoint

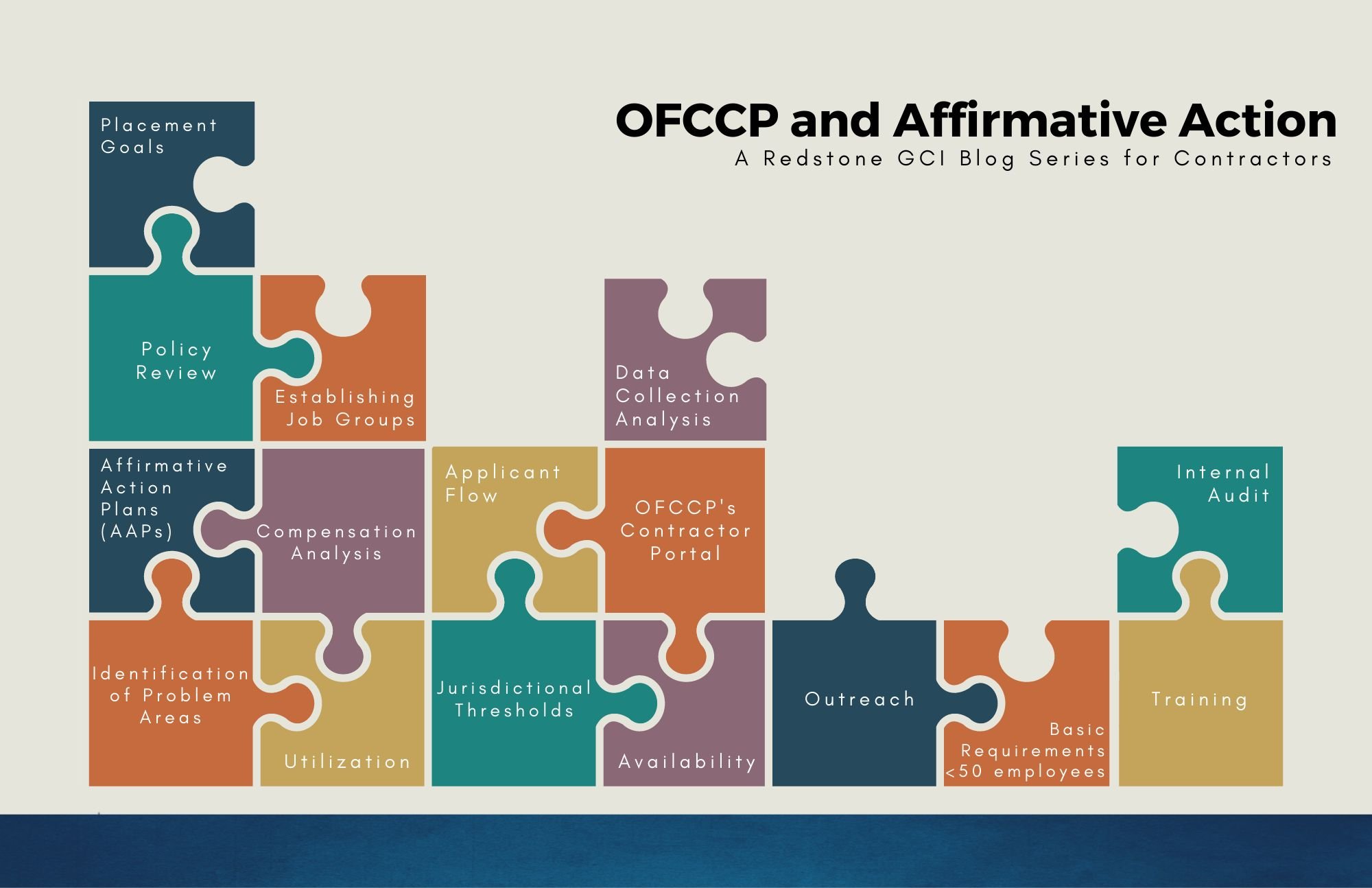

This article is under review as a result of EO 14173, Ending Illegal Discrimination and Restoring Merit-Based Opportunity, signed by President Trump on January 21, 2025. As we await further information from OFCCP and the courts, please reference this article for current status and action items.

As mentioned throughout this series on Office of Federal Contract Compliance Programs (OFCCP) and Affirmative Action (AA), recordkeeping is essential. A particularly important component when developing your AAP , as shown in a previous blog, is Applicant Flow (i.e., records pertaining to each “applicant”). When working with clients, we find that this tends to be the most complex and often confusing information requested. Following are answers to some of the most common questions we are regularly asked:

Topics: Government Compliance Training, Human Resources, Office of Federal Contract Compliance Programs

The Department of Justice (DOJ) settled one of the first lawsuits related to alleged cybersecurity fraud by Aerojet Rocketdyne, a defense contractor. So how did it begin. Aerojet Rocketdyne hired an employee as the Senior Director for Cyber Security, Compliance and Controls. The employee asserts that Aerojet misrepresented its compliance with the cyber requirements in DFARS 252.204-7012 when communicating with government officials to obtain DOD and NASA contracts between 2013 and 2015. The employee later refused to sign documents stating Aerojet was compliant with the cybersecurity requirements and reported it to the company’s ethics hotline and filed an internal company report. The employee was terminated and filed a qui tam suit alleging cybersecurity fraud under the False Claims Act.

Topics: DFARS Business Systems, Contractor Purchasing System Review (CPSR), Cybersecurity

In the Lockheed Martin ASCBA Case 62209 Lockheed Martin Aeronautics Company April 13, 2022 Decision, the Board found that when there is a Congressionally established statute of limitation the “theory of laches” does not apply.

Topics: Government Regulations, Federal Acquisition Regulation (FAR)

It’s Government year-end, meaning government contractors are working overtime to process contract awards and modifications. Taking the necessary steps to set up Unanet correctly will save your business time later and ensure the program managers can track their projects properly.

Topics: Unanet

As a small business you know all too well the challenges of managing your back-office accounting activities with limited resources. The headache that comes with reconciling data from an entry-level third-party accounting tool and trying to maintain governmental compliance standards, while being prepared for a contract audit at any time, can be overwhelming for a small finance team.

Topics: Deltek Costpoint

DoD issued a final rule on April 26, 2022, amending the FAR to support the Small Business Administration regulation of including overseas contracts in agency small business contracting goals. The final rule is effective May 26, 2022.

Topics: Proposal Cost Volume Development & Pricing, Small Business Compliance, Contracts & Subcontracts Administration, DFARS Business Systems