This is the third blog in a three-part series on progress payments for Government contractors. In this blog we will discuss the estimate to complete, and the adjustments needed when there is a projected loss on a contract.

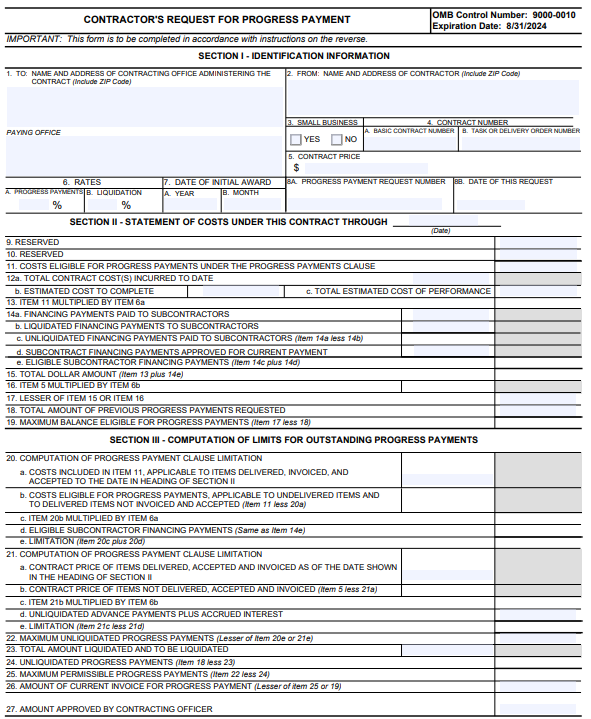

What is the Difference Between Line 11 and Line 12a on SF1443?

Example SF1443 – Contractor’s Request for Progress Payment

In the prior (second) blog of this progress payment blog series, we discussed Line 11 – Costs Eligible for Progress Payment, which is the total allowable costs that are eligible for reimbursement adjusted for a projected loss.

Line 12 is slightly different and represents total contract costs incurred to date. Let’s begin with Line 12a which is the total contract costs incurred to date. The amount on Line 12a is usually the same amount as Line 11 on the SF1443. The only difference would be when there are costs that are not eligible for billing (e.g., material costs that were not paid/or won’t be paid within 30 days of the request for progress payment or pension/retirement fund costs that were not paid timely, etc.) or there is an adjustment for potential loss.

The Estimate to Complete is the Contract Price Less the Costs Incurred, Right?

Not really. It is common for contractors to subtract the cost incurred to date (Line 12a) from Line 5, the contract price, to calculate the Estimate to Complete (ETC). This method may be acceptable the first couple of months of the period of performance because the contract is on schedule. However, the SF1443 instructions state the contractor shall furnish estimates to complete that have been developed or updated within 6 months of the progress payment. The estimates should reflect the estimate of total costs to complete all remaining contract work and include sufficient detail for Government verification.

A technical analysis of the contractor’s Estimate at Completion (EAC), (total costs incurred plus the Estimate to Complete) is normally performed by a government engineer. The review can be an in-depth process therefore it is usually performed under a post payment progress payment request (after payment is made to the contractor).

The EAC (total costs incurred to date plus ETC) is used to identify whether there is a projected cost overrun (i.e., a loss). When the EAC is higher than the contract value, it results in a projected loss on the contract. This requires the calculation of a loss ratio which is applied to the eligible costs in determining the reimbursable amount in Section II Statement of Costs, line 11. The amount in 20a Section III Computation of Limits for Outstanding Progress Payments would also be adjusted to reflect the contract price of items delivered if there is a loss ratio.

How is the Loss Ratio Calculated?

The loss ratio is calculated by dividing the Estimate at Completion by the Contract Price.

Contract Value $5,000,000 = 96.15%

EAC $5,200,000

For simplicity purposes the example below shows how a loss ratio is applied in Section II of the SF1443 based on the following assumptions:

- Progress payment number 1 (no previous progress payments)

- There are no subcontract payments (Line 14)

- No deliveries (Section III of the progress payment form)

Section II – Statement of Costs under this contract through July 31, 2021

|

Line Number |

Description |

Amount |

Amount |

|

Amounts with Loss Ratio of 96.15% Applied |

|

Line 5 |

Contract Price |

|

$5,000,000 |

|

$5,000,000 |

|

Line 6A |

Progress Payment |

|

90% |

|

|

|

Line 6B |

Liquidation Rate |

|

90% |

|

|

|

Line 11 |

Eligible Costs |

|

$2,200,000 |

Line 11 x 96.15% |

$2,115,300 |

|

Line 12a |

Incurred Costs |

$2,200,000 |

|

|

|

|

Line 12b |

ETC |

$3,000,000 |

|

|

|

|

Line 13 |

Line 11 x 6a |

|

$1,980,000 |

Line 11 x 6a |

$1,903,770 |

|

Line 14 |

Sub Financing |

|

0 |

|

0 |

|

Line 15 |

Line 13 plus 14 |

|

$1,980,000 |

|

$1,903,770 |

|

Line 16 |

Line 5 x Line 6b |

|

$4,500,000 |

|

$4,500,000 |

|

Line 17 |

Less of 15 or 16 |

|

$1,980,000 |

|

$1,903,770 |

|

Line 18 |

Total of Previous progress payments |

|

$0 |

|

$0 |

|

Line 19 |

Maximum Eligible (Line 17 less 18) |

|

$1,980,000 |

|

$1,903,770 |

If there is not a projected loss on the contract, the amount eligible for progress payments is $1,980,000. However, since the contract is in a loss position, the loss ratio is applied to the eligible costs and the calculations will mathematically flow through the SF1443. The amount eligible for progress payments with the loss ratio applied is $1,903,770.

It is important to make sure your EAC is accurate. If a government representative finds that it is understated, a loss ratio will be calculated and applied to the progress payment, and will reduce the amount received on your next progress payment request, resulting in a reduction of the next progress payment. Contractors need to make sure they prepare/update a detailed ETC every 6 months in accordance with the SF1443 instructions. The Government auditor may also report EAC issues and failure to prepare/update ETCs as a significant deficiency under DFARS 252.242-7006, Accounting System Administration, (c)(16) requiring “Billings that … comply with contract terms.”

Redstone GCI is available to assist contractors and subcontractors in their preparation of progress payment requests and in assisting with calculating and applying a loss ratio, if applicable. Redstone GCI assists contractors throughout the U.S. and internationally with understanding the Government’s expectations and requirements related to compliance with Government contracting terms and conditions.

Lynne is a Director with Redstone Government Consulting, Inc. providing government contract consulting services to our clients primarily related to Commercial Item Determinations and support, Cost Accounting Standards, DFARS Business System Audits, Proposals, and Incurred Cost. Prior to joining Redstone Government Consulting, Lynne served in several capacities with DCAA and DCMA for over 35 years. Professional Experience Lynne began her career working with DCAA in the Honeywell Resident Office, Clearwater, FL in 1984. Lynne’s experience included various positions which involved conducting or reviewing forward proposals or rate audits, financial capability audits, progress payments, accounting and estimating systems, cost accounting standards, claims and disclosure statement reviews. She is an expert in FAR, DFARS, CAS and testified as an expert witness. Lynne assisted in drafting the commercial item guidance for DCAA Headquarters. Lynne was assigned as a Regional Technical Specialist where she provided guidance to 20 field offices on highly complex or technical issues relative to forward pricing, financial capability or progress payment issues. As an Assistant for Quality, she was involved in reviewing and ensuring audit reports were in compliance with policy and GAGAS as well as made NASBA certified presentations to the staff including but not limited to billing reviews, CAS, unallowable cost and progress payments. To enhance her experience in government contracting, Lynne accepted a position with DCMA in 2015 as part of the newly organized DCMA Cadre of Experts in the Commercial Item Group. This included performing reviews of prime contractor’s assertions and/or commercial item determinations as well as performing price analyses. Lynne was a project lead and later became a lead analyst where she engaged with the buying commands on requests and reviewed price analysis reviews performed by a team of 5 analysts. She also assisted the DCMA CPSR team relative to commercial items and co-instructed the Commercial Item Training presented to DCMA. Education Lynne earned a Bachelor of Science Degree in Accounting from the University of Central Florida. Certifications State of Florida Certified Public Accountant State of Alabama Certified Public Accountant Defense Acquisition Workforce Improvement Act (DAWIA) Level III- Auditing DAWIA Level III – Contracting

Lynne is a Director with Redstone Government Consulting, Inc. providing government contract consulting services to our clients primarily related to Commercial Item Determinations and support, Cost Accounting Standards, DFARS Business System Audits, Proposals, and Incurred Cost. Prior to joining Redstone Government Consulting, Lynne served in several capacities with DCAA and DCMA for over 35 years. Professional Experience Lynne began her career working with DCAA in the Honeywell Resident Office, Clearwater, FL in 1984. Lynne’s experience included various positions which involved conducting or reviewing forward proposals or rate audits, financial capability audits, progress payments, accounting and estimating systems, cost accounting standards, claims and disclosure statement reviews. She is an expert in FAR, DFARS, CAS and testified as an expert witness. Lynne assisted in drafting the commercial item guidance for DCAA Headquarters. Lynne was assigned as a Regional Technical Specialist where she provided guidance to 20 field offices on highly complex or technical issues relative to forward pricing, financial capability or progress payment issues. As an Assistant for Quality, she was involved in reviewing and ensuring audit reports were in compliance with policy and GAGAS as well as made NASBA certified presentations to the staff including but not limited to billing reviews, CAS, unallowable cost and progress payments. To enhance her experience in government contracting, Lynne accepted a position with DCMA in 2015 as part of the newly organized DCMA Cadre of Experts in the Commercial Item Group. This included performing reviews of prime contractor’s assertions and/or commercial item determinations as well as performing price analyses. Lynne was a project lead and later became a lead analyst where she engaged with the buying commands on requests and reviewed price analysis reviews performed by a team of 5 analysts. She also assisted the DCMA CPSR team relative to commercial items and co-instructed the Commercial Item Training presented to DCMA. Education Lynne earned a Bachelor of Science Degree in Accounting from the University of Central Florida. Certifications State of Florida Certified Public Accountant State of Alabama Certified Public Accountant Defense Acquisition Workforce Improvement Act (DAWIA) Level III- Auditing DAWIA Level III – Contracting