Apparently, nothing the Board found was to the liking of the judges at the United States Court of Appeals for the Federal Circuit in Case Number 21-2304, Secretary of Defense v. Raytheon Company, Raytheon Missile Systems, decided January 3, 2023. This was the appeal from the Armed Services Board of Contract Appeals in Nos. 59435, 59436, 59437, 59438, 60056, 60057, 60058, 60059, 60060, and 60061.

Topics: Incurred Cost Proposal Submission (ICP/ICE), Government Regulations, Federal Acquisition Regulation (FAR)

Effective for tax years after December 31, 2021, companies that have research and development expenditures will be required to amortize their R&D costs instead of deducting them in the current year. So, what is the impact – an increased tax bill beginning in 2022.

Topics: Accounting System Compliance, DFARS Business Systems, Cost Accounting Standards (CAS), Federal Acquisition Regulation (FAR)

Schedules B, C, D, and Fringe are some of the most important parts of the Incurred Cost Submission. This vLOG will briefly explain the Incurred Cost Submission, how to complete Schedules B, C, D, and Fringe, and the importance of each schedule.

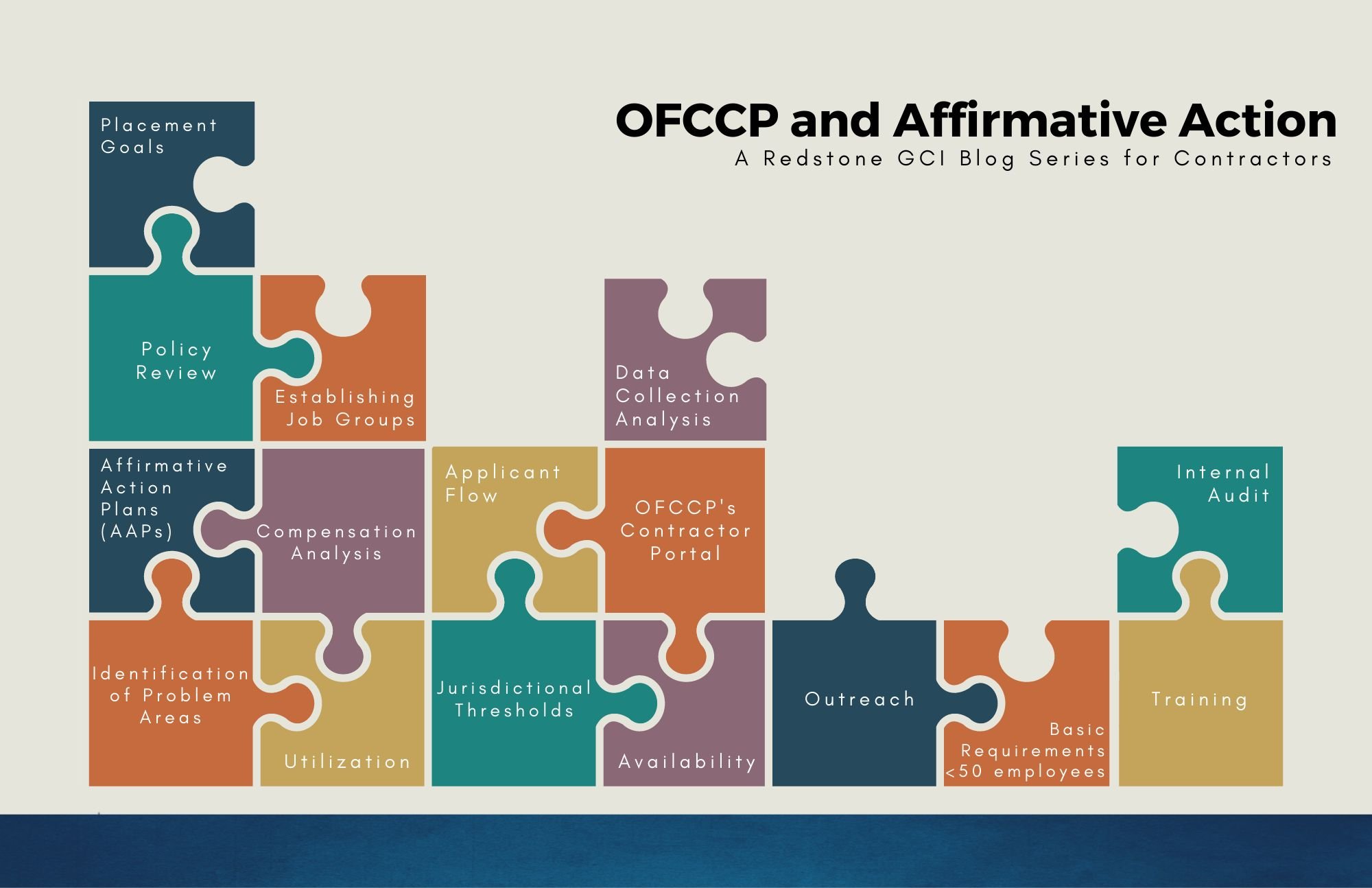

This article is under review as a result of EO 14173, Ending Illegal Discrimination and Restoring Merit-Based Opportunity, signed by President Trump on January 21, 2025. As we await further information from OFCCP and the courts, please reference this article for current status and action items.

Throughout this series, we’ve explored the fundamentals of compliance with the regulations administered by the Office of Federal Contractor Compliance Programs (OFCCP) and many of the components of a written Affirmative Action Plan. In this final blog of the series, we will answer a question frequently asked of us…What do you do with all this information?

Topics: Government Compliance Training, Human Resources, Office of Federal Contract Compliance Programs

As the year comes to an end, there are some additional considerations and setup items that need to be completed. Unanet is a comprehensive accounting system that offers clear procedures for closing on the Support Site. Every company is different, therefore, we at Redstone GCI wanted to provide a checklist and a few links to the Unanet Support Site to help guide you through the Year-End Process smoothly and efficiently:

Topics: Unanet

Thank you to all of our sponsors and attendees for their support of the 2022 Redstone Edge Conference. All profits from the conference are being donated to Castin’ ‘N Catchin’.

Topics: Redstone GCI, Vlog

The Department of Defense (DoD) released new final rulings on October 28, 2022, but what are they and are they really important? Let’s look at significant ones and what’s important:

Topics: DFARS Business Systems, Government Regulations, Estimating System Compliance

Importance of Basis of Estimate

The proposal is often the procurement parties’ first introduction to a company. It is important to remember that different readers are looking for different types of content from the proposal. From an auditor’s viewpoint, an important part of a contractor’s cost estimating process is preparing the basis of estimate (BOE).

Topics: Proposal Cost Volume Development & Pricing, Estimating System Compliance

Thanksgiving is one of our favorite times of the year. The sounds of football on the television is a constant, the weather has cooled, the smell of pumpkin spice and nutmeg in every shop and home makes us inhale a little deeper, and the loud chaos of family and friends gathering for a meal is like a symphony to our ears. It is a beautiful holiday and a beautiful time to reflect.

Topics: Redstone GCI

Office of Management and Budget (OMB) issued a memorandum dated September 14, 2022, Subject Enhancing the Security of the Software Supply Chain through Secure Software Development Practices. This is a result of the President’s Executive Order on Improving the Nation’s Cybersecurity.

Topics: DFARS Business Systems, Contractor Purchasing System Review (CPSR), Cybersecurity