A reminder of different contract vehicles and types and common terms in the business. A refresher for those in the industry or primer for those new to contracting.

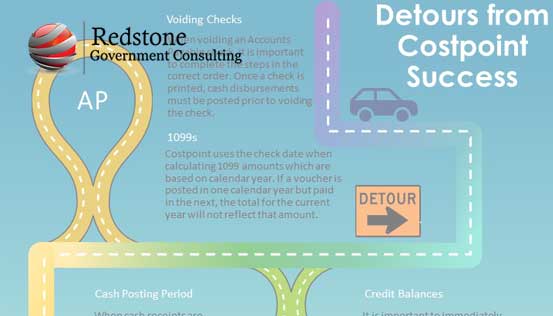

Learn how to avoid the seven most common pitfalls in the Accounting module on your path to Costpoint success. Timing of AP check reversals and posting costs in the wrong accounting period can have serious impacts on accuracy of reporting and productivity within your organization.

DCAA Takes the Lead Over Office of Federal Procurement Policy (OFPP)

In 2013, Congress put in place a new process for the calculation and publication of the compensation limitation (Cap) for all federal contractor employees. The process places the responsibility to calculate and publish the cap using the Bureau of Labor Statistics (BLS) Employment Cost Index (ECI) data on the Office of Federal Procurement Policy (OFPP). OFPP has failed in this responsibility for the last few years.

Topics: Employee & Contractor Compensation, Incurred Cost Proposal Submission (ICP/ICE), DCAA Audit Support, Government Regulations, Federal Acquisition Regulation (FAR)

Physical floorchecks appear to be a thing of the past, at least during this COVID-19 pandemic. Watch our video as we walk you through a scenario, as experienced by a Government Contractor, of a virtual floorcheck. We play out the roles and responsibilities of management, compliance and employees as it relates to floorchecks, from DCAA notification, to expectations, to a beautifully acted example of a virtual floorcheck gone RIGHT and a virtual floorcheck gone WRONG. We also lay out questions that may be asked during a floorcheck as well as tips to surviving a DCAA floorcheck that every contractor should consider.

Topics: DCAA Audit Support, Vlog, COVID-19

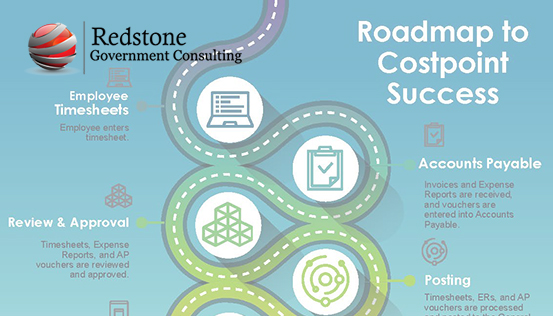

Have you ever wondered how to be successful in Deltek Costpoint? Follow these ten best practices and you’ll be on your way. From the initial submission of the employee timesheet to month end processing, there are many components along the road to being paid and closing out the accounting period.

The Financial Accounting Standards Board (FASB) issued Topic 842, Leases, in February 2016 effective for fiscal years beginning after December 15, 2018. The change was “to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements.” For the past 40 years or so, operating leases were only required to be presented in the disclosure and were off-balance sheet transactions. Other than the new asset (Right to Use asset) and a related liability on the balance sheet, the impact on the income statement (a single line item for lease expense) and cash flow are unchanged, at least under GAAP. International Financial Reporting Standards (IFRS) now requires all leases be treated similar to capital leases (Topic 842 calls these finance leases). So, under IFRS there will be more unallowable interest to properly account for on Government proposals and contracts incorporating FAR Part 31.

Topics: Non-US Government Contractor, Accounting System Compliance, Proposal Cost Volume Development & Pricing, Contracts & Subcontracts Administration, Cost Accounting Standards (CAS)

This article is under review as a result of EO 14173, Ending Illegal Discrimination and Restoring Merit-Based Opportunity, signed by President Trump on January 21, 2025. As we await further information from OFCCP and the courts, please reference this article for current status and action items.

Under the Vietnam Era Veterans’ Readjustment Assistance Act (VEVRAA), federal contractors and subcontractors with contracts valued at $150,000 or more are required to file an annual VETS-4212 report disclosing the number of veterans in their workforce. All contractors and subcontractors who meet the contract threshold amount are required to file a VETS-4212 report, regardless of their total number of employees. Data reported through form VETS-4212 is used by the Office of Federal Contract Compliance Programs (OFCCP) to conduct compliance evaluations. The annual filing period for form VETS-4212 is August 1 through September 30. The 2020 filing deadline is September 30, 2020.

Topics: Human Resources, Office of Federal Contract Compliance Programs

If your business pipeline is growing and you are issuing more subcontracts of higher values, Contractors should be aware that your organization has a duty under 48 CFR §22.805 to the Office of Federal Contract Compliance Programs (OFCCP).

Topics: Contracts & Subcontracts Administration, Contractor Purchasing System Review (CPSR), Government Regulations, Federal Acquisition Regulation (FAR)

Apportioning the Costs of Buildings

The SBA and Treasury have made it clear that if you own or lease a building that you sublet to another company, the portion of the lease or mortgage expense that can be used as nonpayroll costs for PPP loan forgiveness is limited to the share of the expense applied to the business who’s PPP loan is being forgiven. The simple example is, you lease an office building for $10,000 per month and sublease part of the space to another company for $2,500 per month. Only $7,500 would be used toward your nonpayroll cost for loan forgiveness. This proration applies to utility and other shared costs of the tenants.

Topics: Accounting System Compliance, Defense Procurement & Acquisition Policy (DPAP), Government Regulations, COVID-19, Paycheck Protection Program (PPP) Loans