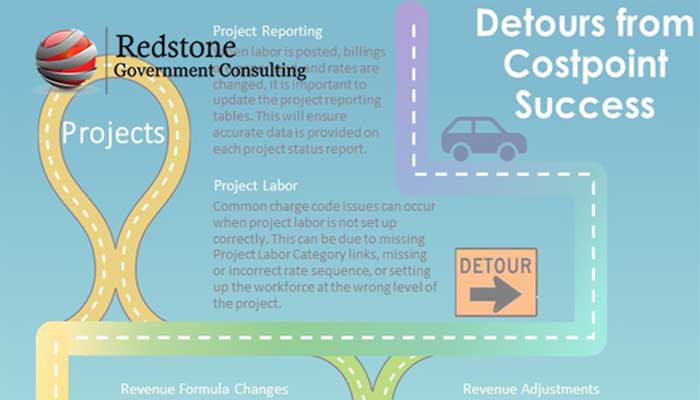

Understand how rate changes and revenue adjustments can wreak havoc on your system when done incorrectly in this path to Costpoint Project success. These issues can be time consuming to correct and can affect all users, even down to the employee level.

A Little Background

FAR Part 31, Cost Principles, is the regulation that government contractors must follow in order to account for cost on most government contracts. Within FAR Part 31 is FAR 31.205, Selected Costs. This part of the cost principles regulation specifically spells out unallowable cost that the government will not pay for under a government contract. This section starts at FAR 31.205-1 and goes all the way up to FAR 31.205-52. However, it should be noted that FAR 31.205-2, 5, 9, 24, 45, and 50 are “Reserved” – These reserved cost areas went the way of the dinosaur over time, hopefully not to return. For example, FAR 31.204-2, Automatic Data Processing Equipment Leasing Costs, required an annual demonstration that leasing computer equipment was cost-effective, i.e., lowest cost to the Federal Government.

Topics: Incurred Cost Proposal Submission (ICP/ICE), Contracts & Subcontracts Administration, Government Compliance Training, DCAA Audit Support, Government Regulations, Federal Acquisition Regulation (FAR)

What is a Contract Brief?

A contract brief is a document which identifies information about the contract, contract administration representatives and significant contract terms and conditions.

Topics: Accounting System Compliance, Incurred Cost Proposal Submission (ICP/ICE)

Our latest video and article provide answers to a few questions your organization should answer if you are interested in moving to a prime contractor role. This change will affect your business operations, so your staff should consider it and plan for the future. From proposal development to subcontract management, your organization may experience some growing pains.

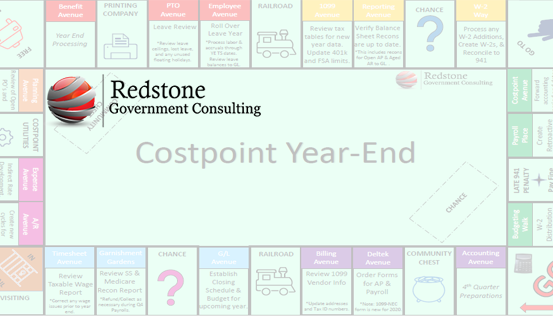

As year-end approaches, you may be wondering if there is anything you can do ahead of time to prepare. Here we’ve outlined some quarter 4 checks and processing steps so you don’t land in jail! Find an issue on your FICA recon report or have trouble getting your 1099s to align? Redstone Costpoint consultants are here to assist and support you all the way through the year end process.

Topics: Deltek Costpoint

Thanksgiving is one of our favorite holidays because it is not about what we can receive, but what we can give. It is an opportunity to reflect on the positive and not focus on the negative that seems to surround us daily. Thanksgiving should be a state of mind we live in daily, and not confined to one day per year. Redstone GCI has a lot to be thankful for this year, we all do. We must dig deep within ourselves to see the blessing placed upon us each day and give thanks for those blessings each and every day. Above all, we are most thankful for God and His constant presence in our lives as we navigate each day and every occasion.

Topics: Redstone GCI

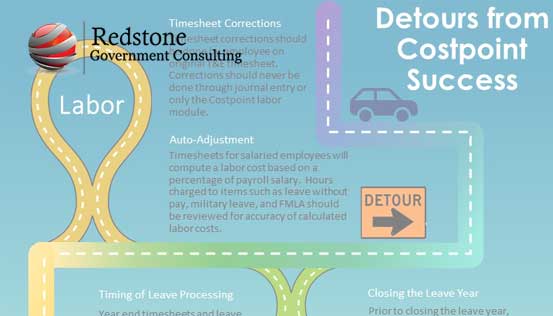

Problems with timesheet corrections or payroll variances? Follow the road to skillfully detour around these frequent People Module issues.

Topics: Deltek Costpoint