DCAA’s Authority for Interim Vouchers

DCAA is given the authority under DFARS 242.803(b) to approve interim vouchers for DoD. DFARS 242.803(b) states DCAA will approve interim vouchers using sampling methodology for provisional payment after a prepayment review. This also includes reviewing completion/final vouchers and issuing a DCAA Form 1, Notice of Contracts Costs Suspended and/or Disapproved when DCAA questions the allowability of costs.

Read More

Topics:

Compliant Accounting Infrastructure,

DFARS Business Systems

The calendar year ended December 31st and you are closing your books and gathering information for your incurred cost submission that is due June 30th. There is one more requirement you should consider that may have been overlooked. Does your company meet the requirement to input independent research and development (IR&D) costs into the Defense Technical Information Center (DTIC)?

Read More

Topics:

Compliant Accounting Infrastructure,

Incurred Cost Proposal Submission (ICP/ICE),

Cost Accounting Standards (CAS)

DFARS Class Deviation 2020-O0021 Revision

On January 15, 2021, the Principal Director at Defense Pricing and Contracting (DPC) issued a memorandum on the CARES Act Section 3610 Reimbursement Requests, DFARS Class Deviation 2020-O0021, Revision 2. This memorandum revises and supersedes the DFARS Class Deviation 2020-O0021 Revision 1 issued on October 14, 2020. The only revision is to extend the period for which paid leave must be taken from March 27, 2020 through December 11, 2020 to March 27, 2020 through March 31, 2021. The remainder of the memorandum remains unchanged and details are included in Redstone GCI’s blog.

Read More

Topics:

Compliant Accounting Infrastructure,

Incurred Cost Proposal Submission (ICP/ICE),

COVID-19

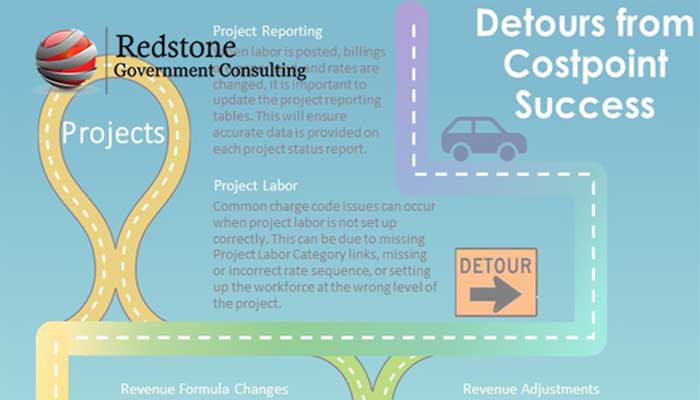

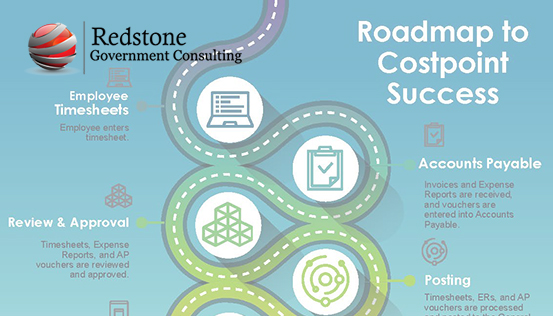

Understand how rate changes and revenue adjustments can wreak havoc on your system when done incorrectly in this path to Costpoint Project success. These issues can be time consuming to correct and can affect all users, even down to the employee level.

Read More

Topics:

Compliant Accounting Infrastructure,

Deltek Costpoint

What is a Contract Brief?

A contract brief is a document which identifies information about the contract, contract administration representatives and significant contract terms and conditions.

Read More

Topics:

Compliant Accounting Infrastructure,

Incurred Cost Proposal Submission (ICP/ICE)

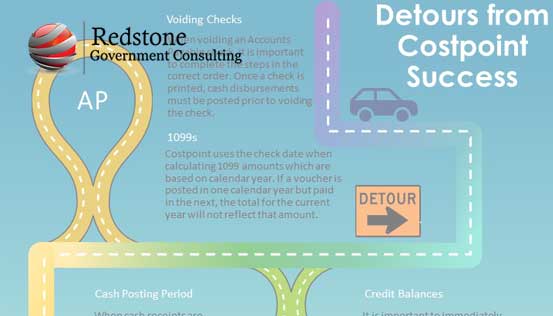

Learn how to avoid the seven most common pitfalls in the Accounting module on your path to Costpoint success. Timing of AP check reversals and posting costs in the wrong accounting period can have serious impacts on accuracy of reporting and productivity within your organization.

Read More

Topics:

Compliant Accounting Infrastructure,

Deltek Costpoint

Have you ever wondered how to be successful in Deltek Costpoint? Follow these ten best practices and you’ll be on your way. From the initial submission of the employee timesheet to month end processing, there are many components along the road to being paid and closing out the accounting period.

Read More

Topics:

Compliant Accounting Infrastructure,

Deltek Costpoint

The Financial Accounting Standards Board (FASB) issued Topic 842, Leases, in February 2016 effective for fiscal years beginning after December 15, 2018. The change was “to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements.” For the past 40 years or so, operating leases were only required to be presented in the disclosure and were off-balance sheet transactions. Other than the new asset (Right to Use asset) and a related liability on the balance sheet, the impact on the income statement (a single line item for lease expense) and cash flow are unchanged, at least under GAAP. International Financial Reporting Standards (IFRS) now requires all leases be treated similar to capital leases (Topic 842 calls these finance leases). So, under IFRS there will be more unallowable interest to properly account for on Government proposals and contracts incorporating FAR Part 31.

Read More

Topics:

Non-US Government Contractor,

Compliant Accounting Infrastructure,

Proposal Cost Volume Development & Pricing,

Contracts & Subcontracts Administration,

Cost Accounting Standards (CAS)

Apportioning the Costs of Buildings

The SBA and Treasury have made it clear that if you own or lease a building that you sublet to another company, the portion of the lease or mortgage expense that can be used as nonpayroll costs for PPP loan forgiveness is limited to the share of the expense applied to the business who’s PPP loan is being forgiven. The simple example is, you lease an office building for $10,000 per month and sublease part of the space to another company for $2,500 per month. Only $7,500 would be used toward your nonpayroll cost for loan forgiveness. This proration applies to utility and other shared costs of the tenants.

Read More

Topics:

Compliant Accounting Infrastructure,

Defense Procurement & Acquisition Policy (DPAP),

Government Regulations,

COVID-19,

Paycheck Protection Program (PPP) Loans

On August 17, 2020; Acting Principal Director for Defense Pricing and Contracting issued two memos providing guidance in support of DFARS Class Deviation 2020-O0013 and 2020-O0021 – CARES Act Section 3610 Implementation. There is also a memo providing contracting officers with a template for a Memorandum for Record to document the file for the issuance of the Section 3610 related contract modification.

Read More

Topics:

Compliant Accounting Infrastructure,

Contracts & Subcontracts Administration,

DCAA Audit Support,

Defense Procurement & Acquisition Policy (DPAP),

Cost Accounting Standards (CAS),

COVID-19