In our blog “Blended Compensation Rate Guidance: Steps to Success”, posted on March 4, 2016, we provided the steps a contractor should take to determine if and how the compensation cap applies. The reference is FAR 31.205-6(p) which establishes a statutory cap on allowable compensation, notably the methodology for determining the cap was changed as was the cap (reduced to $487,000) effective on contracts executed on or after June 24, 2014. The reference to blended rates pertains to a contractor incurring costs in 2014 on contracts executed before June 24, 2014, as well as on contracts executed on or after June 24, 2014. The “old” contracts subject to the previous (more contractor-friendly) regulation with a 2014 cap of $1,144,888 and the “new” contracts subject to the artificially low (and highly political) cap of $487,000.

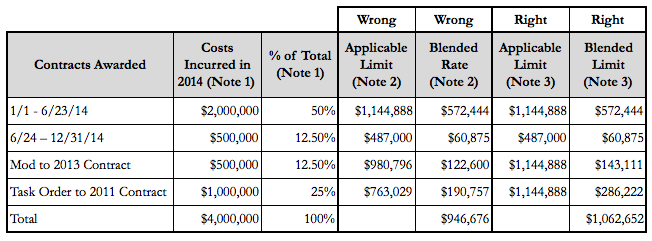

Our previous blog focused on steps to determine if the statutory cap even applies and if it applies, which cap (pre or post-June 24, 2014). We stopped short of providing an illustration but did provide references to a DCAA Audit Policy, which also includes a DCMA policy with illustrations of blended rates. In other words, we assumed that the “mechanics” were relatively straight-forward; however, we recently encountered a newsletter (DC area consulting firm) with an illustration of blended rates which are not in accordance with the underlying regulations. The wrong and the right way to apply the statutory cap are shown below, noting that the “wrong” way is the illustration copied from the other newsletter:

Notes.

- Costs incurred are G&A base costs assuming that compensation subject to the cap is in the G&A pool, e.g. the CEO, CFO, COO. Percentage of the total is for that group of contracts’ costs incurred in 20014 as a percentage of the total (the percentage of the G&A base).

- The applicable limit is incorrectly based upon the year of contract award or specific date of contract award for 2014. For example, the “mod to 2013” incorrectly applied the 2013 statutory cap which only applies for costs incurred on all covered contracts at the beginning of the contractor fiscal year that begins January 1, 2013. The amount which is used to compute the blended rate is the weighted average, percentage of the total applied to the applicable limit. In this illustration, the blended amount is understated because the applicable limit was incorrect for two groups of contracts with execution dates prior to 2014.

- The correct applicable limit is based upon the limitation imposed for the year in which the costs are incurred. For example, for 2014, for costs incurred beginning January 1, 2014, on covered contracts executed before June 24, 2014, the applicable limit is $1,144,888 (reference Federal Register Vol 81, No. 50, Tuesday, March 15, 2016, page 13834 for 2013 and 2014)). FAR 31.205-6(p) prior to June 24, 2014, defined a methodology which included fiscal year specific compensation limits based upon OMB’s published benchmark compensation amount. Thus, the methodology was fixed; however, the applicable limit (amount) varies from year to year. The amount is not fixed based upon the year of contract award (which is reflected in the “wrong” column).

The “other consultant newsletter” reflects a misunderstanding of the cardinal rule that a contract is subject to the FAR provisions in effect on the date of contract execution. In the case of FAR 31.205-6(p), there have been different methodologies and different benchmark amounts, some fixed and some variable (i.e. determined by OMB applicable to a stated fiscal year). At its inception (1996), FAR 31.205-6(p) did impose limitations in absolute, fixed amounts; however, that method was replaced in 1998 by a method which varies the allowable amount based upon fiscal year specific caps. Even now, the June 24, 2014, regulation involves a baseline of $487,000 which is subject to increases as determined and published by the Administrator of OFPP (Office of Federal Procurement Policy). The lower baseline may appear to be fixed at $487,000 simply because the OFPP Administrator has not published an increased amount for 2015 or 2016 (obviously not in any hurry to slightly increase allowable compensation for contractors).

One final thought, there are a multitude of advisory newsletters, some right, and some wrong. Use with caution.

Mike Steen is a Emeritus Advisor with Redstone Government Consulting, Inc. and a specialist in complex compliance issues to include major contractor cost accounting & business system regulations, financial compliance, resolution of DCAA audit issues, Cost Accounting Standards application, litigation support, and claims preparation. Prior to joining Redstone Government Consulting, Mike served in a number of capacities with DCAA for over thirty years, and upon his retirement, he was one of the top seven senior executives with DCAA. Mike Served as a Regional Director for two DCAA regions, and during that time was responsible for audits of approximately $25B and 800 employees. In October 2001, he was selected for the Senior Executive Service and in 2006 he received the Presidential Rank Award. During Mike’s tenure with DCAA, he was involved in conducting or managing a variety of compliance audits, to include cost proposals, billing systems, Cost Accounting Standards, claims, defective pricing, and then-evolving programs such as restructuring, financial capability and agreed-upon procedures. He directly supported the government litigation team on significant contract disputes and has prepared and presented various lectures and seminars to DCAA staff and business community leaders. Since joining Redstone Government Consulting in June 2007, Mike has developed and presented training and seminars on Government Contracts Compliance to NCMA, Federal Publications Seminars and various clients. Mike also is a prolific contributor of written articles to government contracting publications, as well as to our own Government Insights Newsletter. Mike also serves as the director of our training service offerings, with responsibilities for preparing and developing course content as well as instructing our seminars to clients and general audiences throughout the U.S. Mike also serves as a faculty instructor for the Federal Publications Seminars organization. Education Mike has a BS Degree in Business Administration from Wichita State University. He is also a graduate of the DCAA Director’s Fellowship Program in Management, and has a Masters Degree in Administration from Central Michigan University. Mr. Steen also completed a number of OPM’s management and executive development courses.

Mike Steen is a Emeritus Advisor with Redstone Government Consulting, Inc. and a specialist in complex compliance issues to include major contractor cost accounting & business system regulations, financial compliance, resolution of DCAA audit issues, Cost Accounting Standards application, litigation support, and claims preparation. Prior to joining Redstone Government Consulting, Mike served in a number of capacities with DCAA for over thirty years, and upon his retirement, he was one of the top seven senior executives with DCAA. Mike Served as a Regional Director for two DCAA regions, and during that time was responsible for audits of approximately $25B and 800 employees. In October 2001, he was selected for the Senior Executive Service and in 2006 he received the Presidential Rank Award. During Mike’s tenure with DCAA, he was involved in conducting or managing a variety of compliance audits, to include cost proposals, billing systems, Cost Accounting Standards, claims, defective pricing, and then-evolving programs such as restructuring, financial capability and agreed-upon procedures. He directly supported the government litigation team on significant contract disputes and has prepared and presented various lectures and seminars to DCAA staff and business community leaders. Since joining Redstone Government Consulting in June 2007, Mike has developed and presented training and seminars on Government Contracts Compliance to NCMA, Federal Publications Seminars and various clients. Mike also is a prolific contributor of written articles to government contracting publications, as well as to our own Government Insights Newsletter. Mike also serves as the director of our training service offerings, with responsibilities for preparing and developing course content as well as instructing our seminars to clients and general audiences throughout the U.S. Mike also serves as a faculty instructor for the Federal Publications Seminars organization. Education Mike has a BS Degree in Business Administration from Wichita State University. He is also a graduate of the DCAA Director’s Fellowship Program in Management, and has a Masters Degree in Administration from Central Michigan University. Mr. Steen also completed a number of OPM’s management and executive development courses.