The government can terminate a contract, in whole or in part, through special contract clauses referred to as "termination clauses." Contract termination can happen for reasons such as lack of funding, bid protests, changes in military strategy, technological advancement, federal operations, or national political agenda that change the government's needs. However, what are the different types of termination proposals and forms required? This article will sort out the maze of what needs to be done and submitted.

First off, some background on terminations: under a government contract termination, a contractor is expected to immediately stop work, notify its subcontractors/vendors, and terminate whatever work it can. Contract terminations can be:

(1) a termination for convenience, where the government unilaterally terminates a contract, in whole or part, through contractual termination clauses when it is in the government's interest; or

(2) termination for default, where the government terminates a contract because of the contractor's actual/anticipated failure to perform its contractual obligations.

A contractor is responsible for preparing a termination settlement proposal within one year of the effective termination notice. The contract type determines the termination settlement proposal type and prescribed forms needed.

Let's take the easiest one first. If you have a government commercial contract awarded under FAR Part 12 (Acquisition of Commercial Products and Commercial Services), a termination settlement proposal is not required to be submitted on any particular government form. The contractor payment is a percentage of the contract of the work performed prior to the termination notice and reasonable termination costs. It will not be subject to government cost principles or government audits. This type is straightforward and should be coordinated through the termination contracting officer.

However, if the termination for convenience is other than a commercial contract, such as a negotiated contract, the required forms are listed in FAR 49.602-1 and discussed below. Additionally, and this is a big one, the cost principles in FAR Part 31 are applicable even if it was not part of the original contract, and it may be subject to audit if the proposal is over $2 million. The forms also provide for the contractor's certification. Further certification of cost or pricing data may be required if the termination settlement proposal does not meet one of the exemptions in FAR 15.403.

The different termination settlement proposal types and required forms are highlighted below:

For fixed-priced contracts, either the (1) inventory or (2) total cost basis may be used:

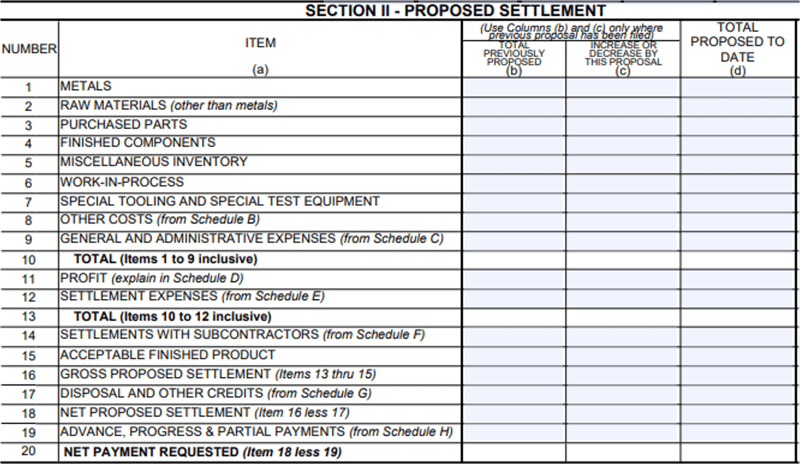

- Inventory Method – This basis is preferred for the termination settlement proposal. Under this basis, the contractor directly associates the inventory costs with units or services terminated. It limits the proposal to those items which are due to the termination action. termination settlement proposals should only include items allocable to the terminated portion of the contract. If under audit, the audit effort relates to reviewing items listed in the inventory schedules supporting the termination settlement proposal. The SF1435, Settlement Proposal (Inventory Basis) shall be used to submit a termination settlement proposal using the inventory method.

The SF1435, Section II (shown below), shows inventory costs, for example, for metals, raw materials, purchased parts, finished components, miscellaneous and work-in-process inventories, as well as other costs/credits, to derive the net payment requested.

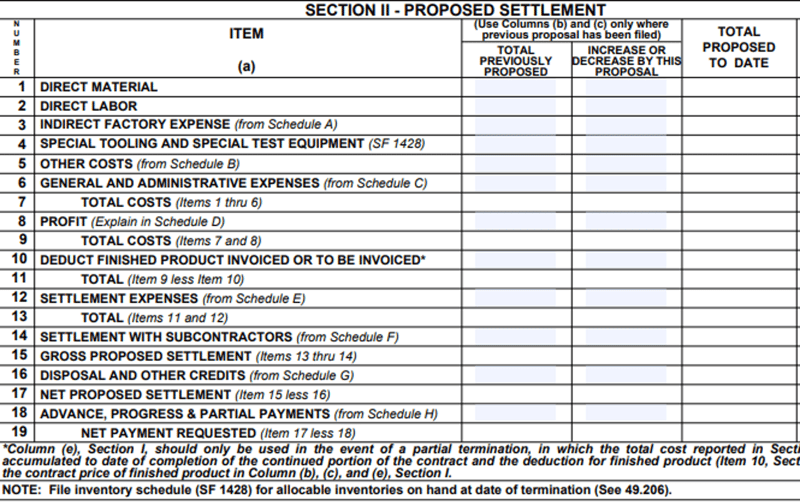

- Total Cost Method – This basis is used when the inventory basis cannot be used and requires the termination contracting officer's approval. From my experience, termination contracting officers are willing to approve this method. Since this method is based on total contract costs, inventory cost is included in the costs of material, labor, and overhead. If the termination settlement proposal is audited, auditors will examine the total cost incurred under both the completed and partially completed portions of the contract.

The SF1436, Settlement Proposal (Total Cost Basis), Section II (shown below), presents cost by cost elements and includes direct labor, direct material, indirect costs, settlements with subcontractors, applicable settlement expenses, profit (or loss) adjustment, to derive the net payment requested.

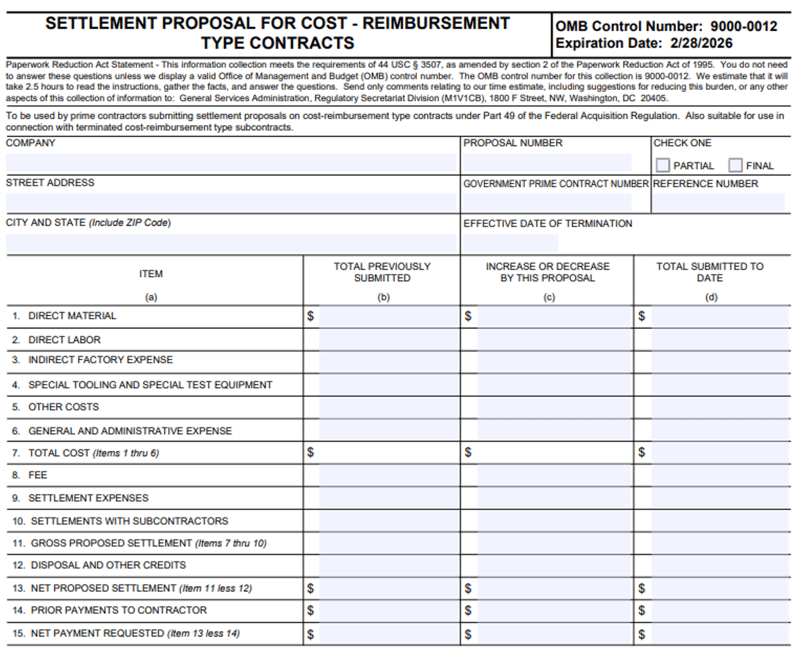

For cost-type contracts, the SF1437, Settlement Proposal for Cost- Reimbursement Type Contracts, shall be used to submit a termination settlement proposal. It is like the total cost basis using cost elements with no associated schedules.

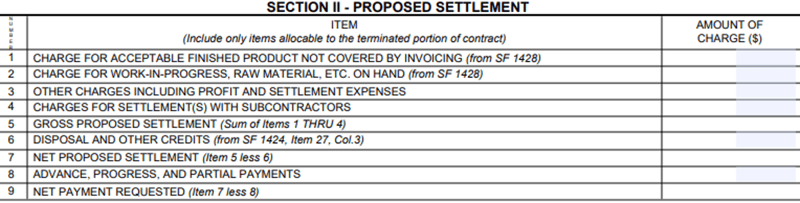

(d) SF1438, Settlement Proposal (Short Form), shall be used to submit settlement proposals resulting from the termination of a fixed-price contract if the total proposal is less than $10,000. SF1438, Section II (shown below), shows the abbreviated format, which is like the inventory basis.

Two additional forms may be needed:

- SF1439, Schedule of Accounting Information, must be submitted for each termination under a contract for which a settlement proposal is submitted, except when the short form SF1438 is used.

- SF1428, Inventory Disposal Schedule, and (potentially) SF1429, Inventory Disposal Schedule-Continuation Sheet, shall be used in termination settlement proposals where an SF1436 or SF1438 are used.

For a termination for default, this is more of a legal matter, and a specific termination settlement proposal is not required. Before the government terminates a contract for default, the contracting officer will usually give a contractor a written notice, called a "cure notice." This notice specifies the failure and provides at least 10 days to cure any defects. Unless the failure to perform is cured within 10 days or the period provided, the contracting officer may issue a termination for default notice. Further, the government may claim damages for a contractor's failure to perform and the costs related to the government procuring goods or services from an alternative source. Your contract cannot be terminated for default if you can prove that your failure to perform is excusable and not caused by your own fault or negligence.

Lastly, there is an avenue for termination settlements when both the government and the contractor may be at an impasse. This is a Contract Disputes Act claim. A Contract Disputes Act is a claim for money that provides for a written demand by one of the contracting parties seeking, as a matter of right, the payment of money in a sum certain, the adjustment or interpretation of contract terms, or other relief arising under or relating to the contract. Some types of claims are not subject to the Contract Disputes Act, such as prevailing wage claims under the Davis Bacon A and certain tort claims. A claim under the Contract Disputes Act requires a contractor certification using the language from FAR 33.207(c). The Contract Disputes Act requires that, prior to litigation, the parties to the contract must exhaust administrative remedies and have received a written decision from the contracting officer. The contracting officer needs to decide on the claim within 60 days unless the claim is for more than $100,000, in which case the CO must provide a date upon which a decision will be made. This procedure required prior to pursuing litigation.

Takeaway - A termination settlement proposal provides a vehicle for contractors to seek reimbursement of contract costs that were due to the government's decision to terminate the contract. Understanding the prescribed forms, process, certification, and due date is just the beginning of getting your terminated contract settled.

How Can Redstone GCI Help?

Redstone Government Consulting offers comprehensive assistance tailored to your company's needs, including support in preparing termination proposals and reviewing contractor submissions prior to their finalization. Our expertise extends to providing specialized training on termination proposals through flexible options such as webinars or onsite sessions. With our guidance, you can navigate termination processes with confidence, ensuring accuracy and compliance every step of the way.